Banking and Taxation:

Financial Services and Taxes in Shanghai

Some foreigners may find it challenging to open a bank account in Shanghai. This is especially so for local banks because they lack staff who are proficient in the use of English. When you visit a bank in Shanghai to open an account, we recommend you to bring a trusted friend who can speak and read Chinese fluently. Alternatively, choose an international bank that have counter staff who can converse well in English.

If you are an expatriate who is planning to relocate to Shanghai, you can apply for a global bank account online even before you arrive in Shanghai. You can have your account set up and your banking arrangements, such as salary credit and funds transfer, made before moving here to Shanghai.

|

Shanghai is still predominantly cash-based. Don't assume you will be able to use your credit card anywhere but in major hotels. A handful of restaurants - usually only western-managed - accept cards and, of course, most department stores accept credit cards but the length of time it takes to complete a transaction can be frustrating and not reassuring. There saying, try and carry a reasonable sum of cash.

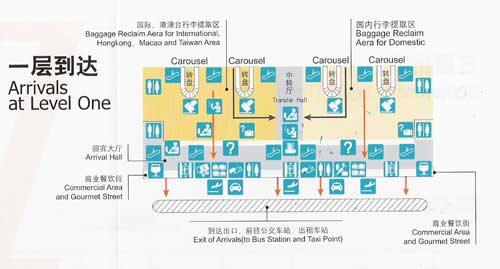

There are ATMs at the arrival hall in Pudong Airport (see above) as well as currency exchange counters. Some, but nothing like all ATMs take international cards on systems like Cirrus, Plus, Mastercard and Visa. It might be the case that you have to try three or four Chinese banks before it allows you to withdraw money. Check with your bank at home to make sure that your card will be valid overseas.

It's useful to remember that all banks follow the Bank of China rates, so it doesn't matter where you change money -- they're all the same.

Although Shanghai is beginning to move towards credit, it is still overwhelmingly a cash economy. Utility and phone bills are paid in cash at your local post office, and stored value cards are used for some services like mobile phones and subways.

Credit cards are accepted at major hotels, higher end restaurants, departments stores and upscale fashion boutiques and at most services catering to expats.

Stored value cards are purchased for a certain value (e.g. 100 RMB), and then topped up as needed. Stored value subway and bus cards can be purchased, as can stored value cards for mobile phones.

Personal checks are not used in Shanghai due to forgery. Checks are generally only used in business transactions, and there are a long list of rules governing how they must be written, down to a special way of writing numbers on checks!

The Chinese currency is called 'Yuan', or you will hear it more commonly called 'Kuai'. The Chinese yuan (RMB) is not a convertible currency, meaning that you won’t be able to convert it into foreign currency outside of China. Neither will you be able to change RMB into international currency at banks. When you change international currency into RMB, you’ll receive a foreign exchange receipt, showing the amount exchanged. Any unused yuan can be changed back into foreign currency when you leave the country, but you must show the foreign exchange receipt.

There is a foreign exchange black market, but the risks are so high and the gains so small that it is not at all worthwhile.

One yuan (colloquially called ` kuai ’) is divided into ten jiao (`mao’); one jiao is divided into ten fen. RMB bills are issued by the Bank of China in the following denominations: one, two five, 10, 50 and 100. At some point soon, a 500 note will be issued. China’s fifth set of new currency was rolled out over several years beginning in the 1990s, with the most recent (and final) addition to the set being the new purple five yuan note and five jiao coin in 2002.

One yuan (colloquially called ` kuai ’) is divided into ten jiao (`mao’); one jiao is divided into ten fen. RMB bills are issued by the Bank of China in the following denominations: one, two five, 10, 50 and 100. At some point soon, a 500 note will be issued. China’s fifth set of new currency was rolled out over several years beginning in the 1990s, with the most recent (and final) addition to the set being the new purple five yuan note and five jiao coin in 2002.

Old notes, particularly the fives and 100s (issued in 1999) are still in circulation, so don’t be surprised if you receive currency of the same denomination that looks different. Jiao and fen are issued in bills and coins, although the paper jiao and fen are being phased out in favor of the coins. Coins come in denominations of one yuan, one, two, and five jiao and one, two, and five fen, although these days, the fen isn't used much anymore.

Photo:enterAsia Art

|

It's useful to remember that all banks follow the Bank of China rates, so it doesn't matter where you change money -- they're all the same.

|

There are no fully licensed foreign banks in Shanghai as yet, but China's accession to WTO should change that. Thus far Hongkong and Shanghai Bank (HSBC) and Citibank have a scope for retail banking but their services are so limited at present that they will not be able to support your banking needs on a day-to-day basis.

There are no fully licensed foreign banks in Shanghai as yet, but China's accession to WTO should change that. Thus far Hongkong and Shanghai Bank (HSBC) and Citibank have a scope for retail banking but their services are so limited at present that they will not be able to support your banking needs on a day-to-day basis.Photo:enterAsiaArt

|

|

Contact the following banks and inquire if they have full bank status. Most foreign banks in Shanghai are restricted to corporate banking, although this is expected to change in the next few years.

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Note: Charges vary significantly from one bank to another. The minimum balance required to avoid charges can be quite high.

You'll need to prepare a number of passwords/codes for different cards and pin numbers, telephone and internet banking, etc. Think about a few easy to remember (but not easily cracked) codes, but don't use your birthday. You should write these down and keep them in a safe place. Send a registered letter with all codes to your trustee at home for emergency cases. Alternatively send a diskette or VCD with a codeword.

It is highly advisable to open joint accounts or grant authority to your partner. Expatriates in Shanghai usually have responsibilities within China and regionally, and are often away from home for a number of weeks. This authority allows the partner to operate and even close the account in case of an emergency.

Overdrafts and personal credit is still relatively new in Shanghai, and although banks do have overdraft lines and loans, some are reluctant to offer these to foreigners. Check with the individual bank; in some cases a local guarantor may be required.

In some cases, it is the practice to only grant 'overdraft facilities' if you have deposited the same amount of money in the bank.

Although they all have offices here, there are no local versions of international cards like American Express, Master Card and Visa. If you have an internationally-issued card, they will service it, however.

Although they all have offices here, there are no local versions of international cards like American Express, Master Card and Visa. If you have an internationally-issued card, they will service it, however.

In terms of local credit cards, these are increasing in availability all the time but most local credit cards are actually debit cards. If you do a lot of traveling and entertaining locally, it may be useful to get a local card, which is more widely accepted than international cards in local restaurants and hotels and in cities outside of Shanghai.

Bank of China and other major banks will issue credit cards to account holders, but may require a minimum balance maintained. Check with the individual banks.

|

Personal cheques are not issued in Shanghai. Corporate cheques must be written in Chinese, and it's quite complicated - but usually someone in the office will handle this.

Photo: enterAsia Art

Utility and telephone bills can be paid by direct debit through your local bank, in person at your neighborhood post office, or via your mobile phone through service providers like Sumit. Most expats ask their ayi (maid) to pay their bills

Utility and telephone bills can be paid by direct debit through your local bank, in person at your neighborhood post office, or via your mobile phone through service providers like Sumit. Most expats ask their ayi (maid) to pay their bills

.

| Website: | |

| Sumit | http://www.smartpay.com.cn |

|

Chinese income tax is complicated at best, and made even more so by current tax reform as the authorities scrutinize the China’s high-earners. The first question to ask regarding tax is whether you or your company will be bearing the individual income tax obligation.

We advise you to also check implications for your taxation in your home country.

Photo: enterAsia Art

Base salary, bonuses, a fixed cash allowance and payment of income tax are always taxable. However, as an expatriate you are entitled to certain tax exemptions:

| Housing Allowance | |

| Reasonable Business Trip Allowance | |

| Meal and Food Subsidies | |

| Moving and Relocation Expense | |

| Reimbursement Laundry expenses | |

| Reimbursement Language training | |

| Home leave for employee and family (proof of tickets) | |

| Reasonable allowance for children’s education expenses |

China has tax treaties with a number of countries, including the U.S. If you are a citizen of a country with a tax treaty with China, you will be tax exempt if you do business in China for up to 183 days in any one calendar year. If your country does not have a tax treaty with China, it is 90 days.

If you are domiciled/resident in China for at least one year, then you are subject to individual income tax on income from China and overseas, when the latter is attributable to work done in China. If, however, you are in China for less than one calendar year (personal leave and company training don’t count) you are taxed only on income in China.

Tax reporting in China is done monthly and employers are required to withhold Individual Income Tax from employee’s wages and salaries, and to file tax returns with the authorities. It is important to be aware that delaying monthly payments will result in a fine.

Individual Income Tax rates in China fall into three categories: monthly taxable rates, annual taxable rates, and other income. A foreign employee who has spent at least five full years in the PRC is subject to tax on all employment income regardless of the locality of the source or the payer of the income.

|

|

||||||||||||||||||||||||||||||

ExpaInvestor brings news and information to British expatriates around the world. Authoritative and well informed, its editorial is concise and without jargon encouraging a longer read. The ExpaInvestor brings news and information to British expatriates around the world. Authoritative and well informed, its editorial is concise and without jargon encouraging a longer read. The magazine’s features and surveys provide readers with the analysis they need to make informed decisions about their personal financial and investment planning http://www.expatinvestor.com/ |

As China Individual Income Tax (IIT) law leaves a lot of room for interpretation we strongly recommend that experts should handle the many exemptions and provisions offered to the various nationalities such as the 183 -day threshold, stock options, housing subsidies and contributions to foreign insurance plans. Contact your HR department or see the service providers below:

|

This turnover tax is imposed on the sale and import of goods and processing and repair services. The normal rate is 17%.